Introduction – What This Article Covers

In today’s complex healthcare world, finding a hospital that combines advanced medical care, compassionate staff, and a patient-centered approach is essential. This article will provide you with a complete overview of trinity health ann arbor hospital — what it is, why it stands out, its key benefits, how to access its services, common misconceptions, expert tips, frequently asked questions, and a comprehensive conclusion.

By the end, you’ll have a full understanding of why Trinity Health Ann Arbor Hospital is considered one of Michigan’s top healthcare providers.

What is Trinity Health Ann Arbor Hospital?

trinity health ann arbor hospital, located in Ann Arbor, Michigan, is part of the larger Trinity Health system — one of the largest Catholic health care networks in the United States. Formerly known as St. Joseph Mercy Ann Arbor, the hospital rebranded under the Trinity Health name in 2022 to reflect its affiliation with the national Trinity Health organization.

Trinity Health Ann Arbor offers a full spectrum of services, including:

- Emergency care

- Surgery

- Maternity services

- Cancer treatment

- Cardiovascular care

- Orthopedics

- Neurology

- Mental health services

- Rehabilitation and more

With state-of-the-art facilities and a mission rooted in faith-based care, Trinity Health Ann Arbor strives to serve both the body and spirit of each patient.

Why is Trinity Health Ann Arbor Hospital Important?

Access to high-quality medical care can be life-changing. Trinity Health Ann Arbor plays a vital role for residents of southeastern Michigan and beyond, offering:

- Highly specialized medical expertise

- Cutting-edge technology

- A compassionate, patient-first philosophy

- A faith-based mission committed to community health

As part of the larger Trinity Health national system, the hospital benefits from shared resources, research, and best practices across a wide network of hospitals and care providers (Spam Score 0).

Benefits of Trinity Health Ann Arbor Hospital

1️⃣ Comprehensive Medical Services

trinity health ann arbor hospital is a full-service hospital, meaning patients can access nearly every type of care in one location — from routine screenings to complex surgeries and specialized treatments.

2️⃣ Highly Skilled Physicians

The hospital employs board-certified physicians, many of whom are recognized leaders in their fields. Patients benefit from experienced specialists with advanced training.

3️⃣ Advanced Technology

The hospital continually invests in state-of-the-art technology such as robotic-assisted surgery, advanced imaging, and minimally invasive procedures. This leads to better outcomes and faster recoveries.

4️⃣ Integrated Care Teams

Trinity Health Ann Arbor takes a collaborative care approach, where physicians, nurses, therapists, and social workers work together to provide personalized care plans tailored to each patient’s unique needs.

5️⃣ Patient-Centered Experience

With a strong emphasis on compassionate care, patients are treated with dignity, respect, and empathy throughout their treatment journey. Trinity Health’s mission focuses on healing the whole person — body, mind, and spirit.

6️⃣ Faith-Based Mission

As a Catholic healthcare provider, Trinity Health incorporates spiritual care into its healing mission. Chaplaincy services and pastoral care are available to all patients, regardless of faith background.

7️⃣ Community Commitment

Trinity Health Ann Arbor actively supports local health initiatives, education programs, and wellness outreach to improve community health outcomes in Washtenaw County and surrounding areas.

8️⃣ National Recognition

The hospital has consistently earned high rankings for patient safety, quality of care, and overall patient satisfaction, reinforcing its reputation as one of Michigan’s top healthcare institutions.

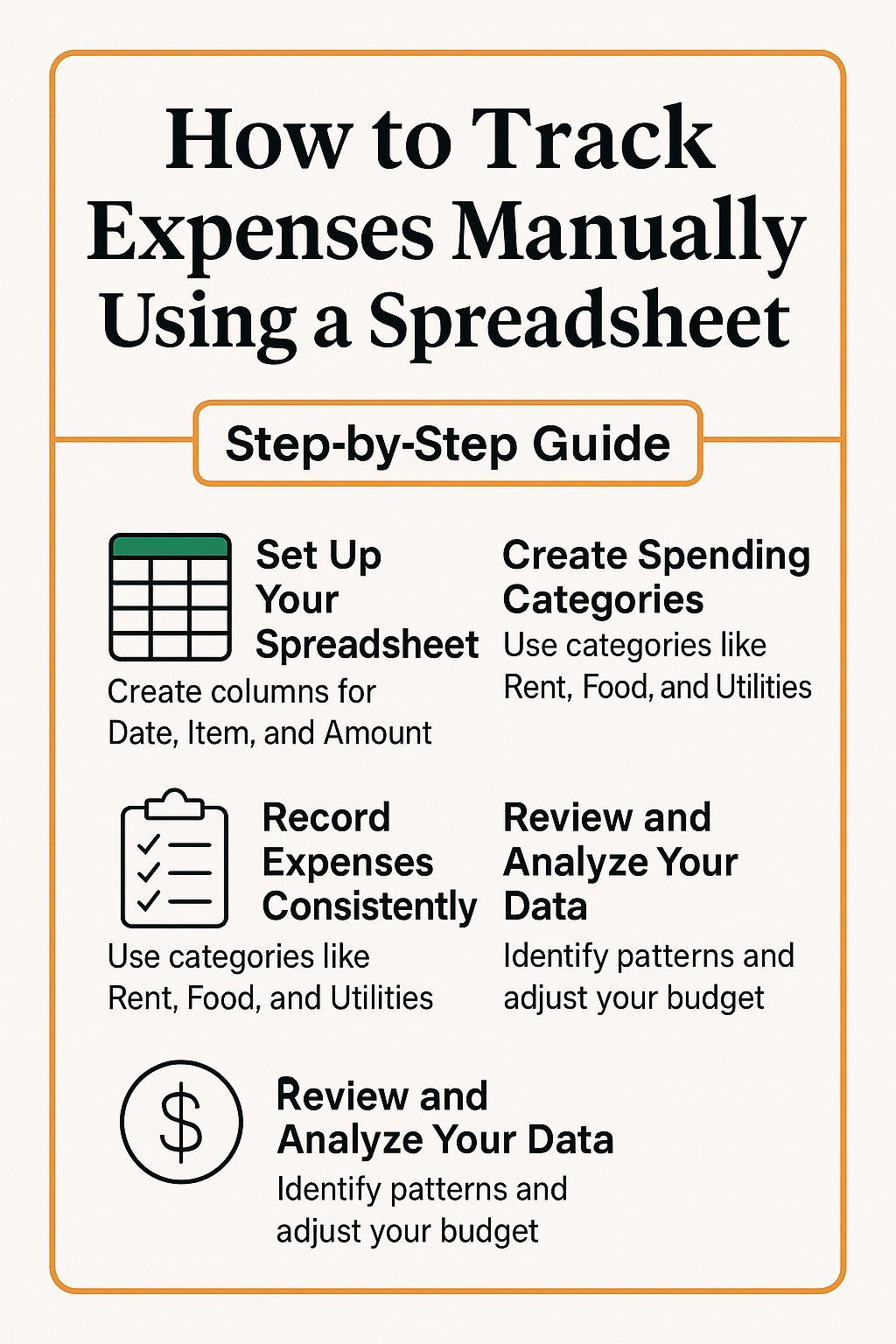

How to Access Trinity Health Ann Arbor Hospital – Step-by-Step Guide

Step 1: Schedule an Appointment

Appointments can be scheduled:

- Online through their official website

- By calling their main scheduling line

- Through a referral from your primary care physician

Step 2: Prepare for Your Visit

Before your appointment:

- Gather medical history documents

- Bring your insurance information

- Prepare a list of questions or concerns for your healthcare provider

Step 3: Arrival and Check-In

Upon arrival:

- Check-in at the front desk

- Provide identification and insurance details

- Follow instructions for parking or valet services if needed

Step 4: Consultation and Treatment

During your visit:

- Meet with your assigned care team

- Undergo any necessary tests, exams, or consultations

- Receive detailed treatment plans, including any follow-up care

Step 5: Follow-Up and Ongoing Care

Trinity Health Ann Arbor emphasizes continuity of care. After your initial visit, you’ll receive:

- Clear instructions for medication or therapy

- Scheduled follow-up appointments

- Access to MyChart, their online patient portal for managing appointments and test results

Common Misconceptions to Avoid

❌ “It’s Just a Local Hospital”

While it serves the Ann Arbor community, Trinity Health Ann Arbor is part of one of the largest national Catholic healthcare systems, offering world-class care and access to cutting-edge treatments.

❌ “Only Catholic Patients Are Welcome”

The hospital serves patients of all faiths and backgrounds. The Catholic mission emphasizes compassionate care, but spiritual services are optional and inclusive.

❌ “Big Hospitals Mean Long Wait Times”

Trinity Health uses efficient scheduling systems to reduce wait times and enhance patient flow, often exceeding national benchmarks for timely care.

❌ “Smaller Cities Don’t Offer Top Specialists”

Ann Arbor is home to some of Michigan’s most renowned physicians, many of whom are leaders in research, clinical trials, and advanced treatments.

Expert Tips for Better Results

✔ Utilize MyChart

Sign up for the Trinity Health MyChart portal to easily:

- View test results

- Manage appointments

- Communicate with your care team

- Access billing information

✔ Verify Insurance Coverage

Before any major procedures, always confirm that your insurance plan covers the services offered at Trinity Health Ann Arbor.

✔ Take Advantage of Support Services

The hospital offers:

- Nutritional counseling

- Financial assistance programs

- Mental health services

- Chaplaincy and pastoral care

✔ Join Community Health Programs

Trinity Health offers community outreach programs, educational seminars, and wellness events that promote lifelong healthy habits.

✔ Don’t Hesitate to Ask Questions

Engage with your care team. Trinity Health’s collaborative approach encourages open dialogue to ensure you fully understand your care options.

FAQs – Frequently Asked Questions

Q1: Where is Trinity Health Ann Arbor Hospital located?

It is located at 5301 McAuley Drive, Ann Arbor, MI 48106.

Q2: Does the hospital accept all insurance plans?

Trinity Health Ann Arbor accepts most major insurance providers, but it’s advisable to verify your specific coverage in advance.

Q3: Is emergency care available 24/7?

Yes, Trinity Health Ann Arbor has a fully staffed Level II trauma center available 24 hours a day.

Q4: What makes Trinity Health Ann Arbor unique?

Its combination of faith-based mission, highly skilled specialists, advanced technology, and personalized care distinguishes it from many other hospitals.

Q5: Can I receive specialized cancer care?

Yes. The hospital offers advanced cancer care, including surgery, chemotherapy, radiation, and access to clinical trials through its partnership with Trinity Health’s extensive oncology network.

Conclusion – Final Thoughts

Trinity Health Ann Arbor Hospital is much more than just a medical facility. It represents a unique blend of cutting-edge technology, expert physicians, compassionate staff, and a mission deeply rooted in serving the community.

Whether you need routine care, specialized treatment, or emergency services, Trinity Health Ann Arbor offers patients an environment where science and compassion work hand in hand. Their national affiliation with Trinity Health ensures ongoing access to research, innovation, and collaborative expertise that continually raises the bar for patient care.

If you live in Michigan or surrounding areas and seek trusted, comprehensive healthcare, Trinity Health Ann Arbor Hospital is a choice you can feel confident about.