Introduction – What This Article Covers

how to track expenses manually spreadsheet ever feel like your money disappears too fast? You’re not alone. Many people struggle to manage their finances, and the main reason is simple: they don’t track their spending. This guide covers everything you need to know about tracking expenses manually using a spreadsheet. From understanding why it matters to step-by-step setup, this article is your all-in-one resource.

What Is Manual Expense Tracking in a Spreadsheet?

Manual expense tracking means you record every expense yourself using a spreadsheet. You don’t rely on apps or automatic syncing. Instead, you enter your data line by line. This method keeps you actively involved in your finances and helps you understand exactly where your money goes. It’s simple, effective, and totally customizable.

Why Is Manual Expense Tracking Important?

Tracking expenses manually offers control and awareness. When you log every transaction, you see your spending habits clearly. Unlike apps, there’s no automation to blur your view. This hands-on approach forces you to think about each purchase and builds a habit of mindful spending. Plus, it helps you stay on top of bills, reduce debt, and plan better.

Benefits of Manual Tracking Using a Spreadsheet

There are many benefits to using spreadsheets for tracking your expenses:

- Customization: You create your categories, layouts, and calculations.

- Cost-Effective: No need for paid budgeting apps or software.

- Control: You decide how to structure your finances.

- Awareness: Manual entry keeps you alert and engaged.

- Accessibility: Access from any device using Google Sheets or store offline with Excel.

- Data Ownership: Your information stays private and secure.

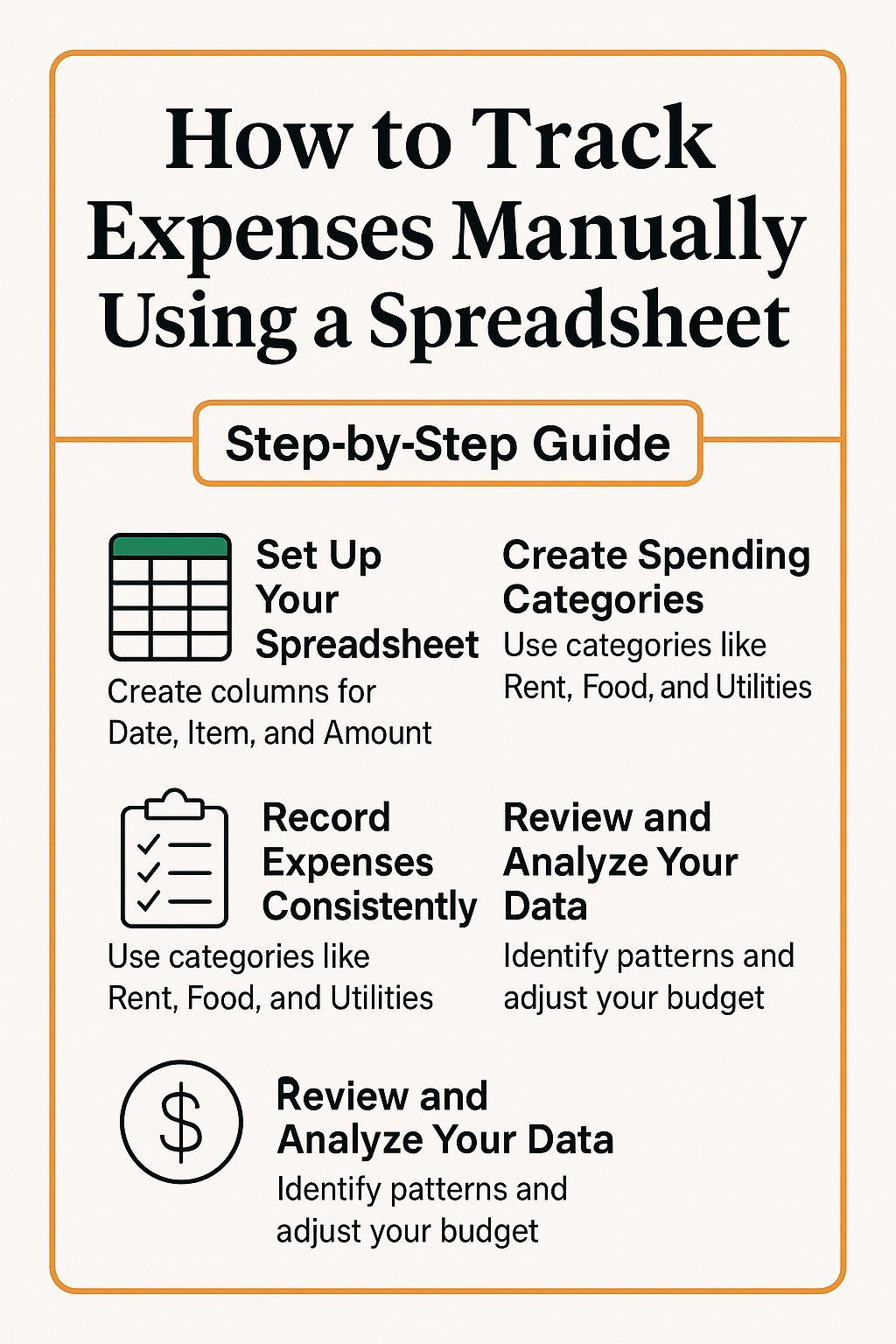

How to Track Expenses Manually – Step-by-Step Guide

Let’s break down the process into clear, actionable steps.

Step 1: Set Up Your Spreadsheet

Open Excel or Google Sheets and start a new file. Label the file something like “Monthly Expenses” or “Budget Tracker.” Create columns labeled:

- Date

- Description

- Category

- Amount

- Notes

This format gives you a clean layout and a starting point for tracking.

Step 2: Create Your Spending Categories

Think of the main areas where you spend money. Common categories include:

- Rent or Mortgage

- Groceries

- Utilities

- Transportation

- Dining Out

- Entertainment

- Healthcare

- Subscriptions

- Miscellaneous

These categories will help you organize your data and analyze patterns later.

Step 3: Log Every Expense Daily

Commit to entering every purchase. Whether it’s a cup of coffee or a utility bill, every expense matters. Enter the data each day, or at least once a week. Use receipts or your bank statements to ensure accuracy. This step is key to building financial awareness.

Step 4: Use Formulas to Automate Totals

Spreadsheets allow you to calculate totals easily. Use basic functions like =SUM() to add up amounts in specific categories or months. You can also use conditional formatting to highlight overspending. For example, if you budget $200 for dining and you spend more, the cell turns red.

Step 5: Review Weekly and Monthly

At the end of each week or month, review your spending. Compare it with your income. Ask yourself:

- Did I stick to my budget?

- Where did I overspend?

- What changes can I make next month?

This review helps you adjust and improve continuously.

Common Mistakes to Avoid

Even with a simple system, people often make errors. Watch out for:

- Inconsistency: Skipping days makes data unreliable.

- Too Many Categories: Keep it simple to avoid confusion.

- Ignoring Small Expenses: These add up over time.

- Lack of Review: Tracking is useless if you don’t analyze the data.

- No Backup: Always save your file online or on an external drive.

Expert Tips for Better Results

Want to level up your spreadsheet game? Try these tips:

- Set daily or weekly reminders.

- Use a separate tab for income.

- Create monthly summary charts or graphs.

- Share your sheet with a partner for shared finances.

- Use color coding to make patterns easy to spot.

- Save templates so you don’t start from scratch every month.

FAQs – Frequently Asked Questions

Q: Can I use this method if I’m not good with Excel?

A: Absolutely. Basic spreadsheet knowledge is enough. You can also find free templates online.

Q: What’s better: Excel or Google Sheets?

A: Both work well. Google Sheets has the advantage of auto-saving and online access.

Q: Do I need to include income in this sheet?

A: Yes, adding a tab for income gives you a full picture of your finances.

Q: What if I miss a few days of tracking?

A: Don’t worry. Just catch up using your bank statement or receipts.

Q: Can couples use the same sheet?

A: Yes, and it’s encouraged. Tracking together improves financial transparency and teamwork.

Real-Life Example: Meet Sarah

Sarah is a 29-year-old teacher in Chicago. She used to rely on budgeting apps but never felt connected to her money. She started using Google Sheets to track every expense manually. Within three months, she cut down on impulse spending and started saving $300 a month. Her tip? “Don’t wait for the perfect sheet. Just start.”

Tracking Income with Expenses

It’s important to track income alongside expenses. Add a second tab named “Income” with columns:

- Date

- Source

- Amount

At month-end, subtract total expenses from total income to find your net savings or loss. This helps you build a long-term savings strategy.

Adding Visuals to Your Spreadsheet

Visual tools like charts and graphs can make your data more understandable. Use pie charts for category spending or bar charts for monthly comparisons. Visuals help spot overspending at a glance. In Google Sheets, use the “Insert > Chart” function.

How to Create a Monthly Budget Using Your Expense Sheet

Once you’ve tracked expenses for one month, use that data to build a realistic budget. Take average spending in each category and set a target. Then each month, compare your actual expenses to your budget. Adjust as needed to stay on track.

Final Thoughts – Take Control of Your Money

Manual expense tracking may sound old-school, but it’s one of the most effective ways to manage your money. It keeps you engaged, builds awareness, and creates accountability. Start small. Stay consistent. Within a few months, you’ll notice real progress.

Whether you’re trying to get out of debt, save more, or just feel more in control, a spreadsheet can be your best financial friend.